The intersection of solar technology and private equity represents a transformative opportunity for both investors and the renewable energy sector. Solar technology once considered a niche industry, has emerged as a high-growth sector, attracting private equity firms eager to align their portfolios with sustainability goals. This article explores how these partnerships drive innovation, profitability, and environmental impact.

Solar Technology: A Bright Spot in Renewable Energy

Advancements in solar technology have significantly enhanced the reliability and efficiency of solar energy systems. Innovations in photovoltaic cells and battery storage now enable energy generation even during cloudy or rainy conditions, making solar a dependable option for residential and commercial applications alike. These developments come at a critical time, as global commitments to reducing carbon emissions create a fertile market for solar solutions. Governments worldwide offer incentives such as tax credits, grants, and subsidies, making solar projects increasingly appealing to private equity investors seeking growth opportunities.

The Role of Private Equity in Solar Innovation

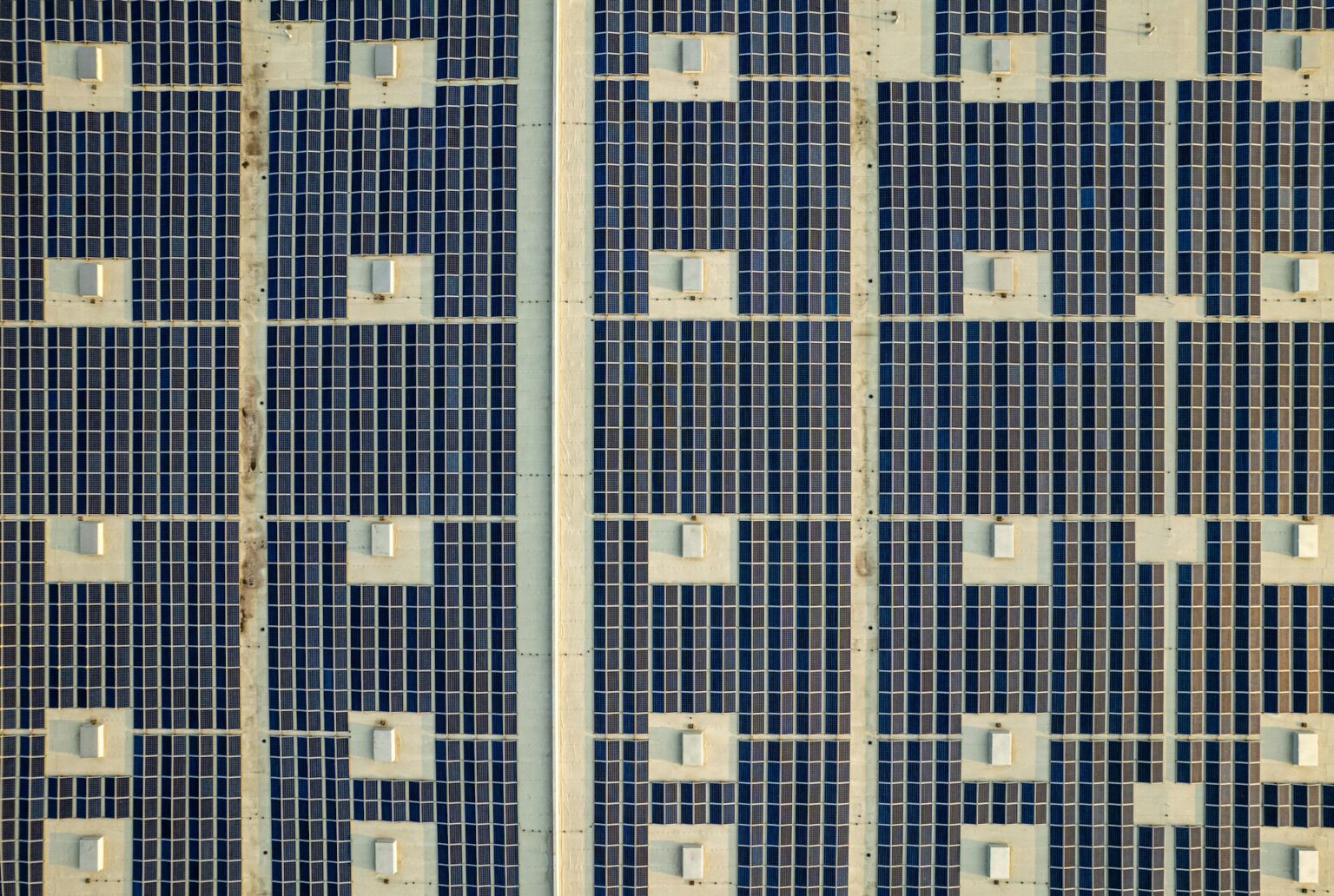

Private equity serves as more than just a financial resource for solar startups; it acts as a catalyst for scaling innovations and expanding market impact. With access to substantial capital and strategic expertise, private equity firms help startups accelerate development timelines, improve operational efficiency, and enter broader markets. This support is vital in transforming pilot projects into large-scale implementations, enabling the renewable energy sector to thrive.

The role of private equity in renewable energy is multifaceted. From funding the construction of solar farms to backing cutting-edge products, private equity investment fosters the growth of startups and drives the global energy transition. For investors, this sector offers not only immense growth potential but also alignment with Environmental, Social, and Governance (ESG) objectives.

Why Solar Startups Attract Private Equity

Solar startups present unique opportunities that make them ideal partners for private equity investors:

- Exponential Growth Potential: Technological advances and declining costs have driven a surge in solar adoption, creating a rapidly expanding market for innovative solutions.

- Long-Term Revenue Streams: Power purchase agreements (PPAs) and other financing models provide predictable cash flows, offering reliable returns for investors while funding ongoing innovation.

- ESG Alignment: Solar startups directly contribute to sustainability goals, enabling private equity firms to meet ESG criteria while supporting meaningful climate action.

- Government Incentives: Policies promoting renewable energy reduce financial risks, making solar projects a smart choice for growth-focused investors.

- Integration with Emerging Technologies: Solar solutions seamlessly connect with trends such as energy storage, electric vehicles, and smart grid technology, creating opportunities for further expansion and revenue generation.

Addressing Challenges Through Strategic Partnerships

Scaling solar solutions is not without challenges, including market volatility and technological hurdles. However, partnerships with private equity firms help mitigate these risks through:

- Diversification: Investments across multiple projects and regions reduce exposure to localized risks.

- Operational Expertise: Many private equity firms bring management experience that complements the technical expertise of startups, enhancing execution and performance.

- Long-Term Vision: With private equity support, solar companies can focus on sustainable growth rather than short-term gains.

Inspirational Success Stories

The success of private equity-backed ventures in the renewable energy sector highlights the potential of these partnerships. Notable examples include firms like BlackRock and KKR, which have invested in solar farms and other renewable energy projects that deliver consistent returns while advancing the clean energy agenda. These collaborations illustrate the powerful synergy between innovative technology and strategic investment.

The Future of Solar Technology and Private Equity

Solar technologies have become a cornerstone in the transition to renewable energy, offering homeowners and businesses innovative ways to reduce electricity costs and carbon footprints. Modern advancements enable solar panels to harness sunlight efficiently, even in diverse weather conditions. While they perform optimally in direct sunlight, new designs allow for energy generation on cloudy days and leverage snow’s reflective properties to enhance performance. By selecting cutting-edge solutions like monocrystalline panels, users can achieve consistent energy output year-round.

The demand for renewable energy is fueling rapid innovation within the solar sector. Technologies such as bifacial solar panels, floating solar installations, and AI-driven energy management systems are redefining what is possible. Private equity is playing a critical role in advancing these innovations, providing the funding needed to bring them to market and scale their impact. By investing in solar technologies, private equity firms are aligning profitability with environmental sustainability, accelerating the global shift toward cleaner, more efficient energy solutions.

Global Transition to Renewable Energy

The integration of solar technology and private equity is a driving force in the global transition to renewable energy. Solar startups benefit from the financial resources and strategic expertise of private equity, while investors tap into a sector with immense growth potential and ESG alignment. Together, these partnerships are shaping a future that is cleaner, smarter, and more profitable for all stakeholders.