In the tumultuous world of startups, cash flow management is not just a necessity but a critical survival skill. The lifeline of any business, especially startups, is dictated by the inflow and outflow of cash. Without a keen eye on cash flow, even the most brilliant ideas can end up in the business graveyard, underscoring why, according to a U.S. Bank study, 82% of business failures are due to poor cash management.

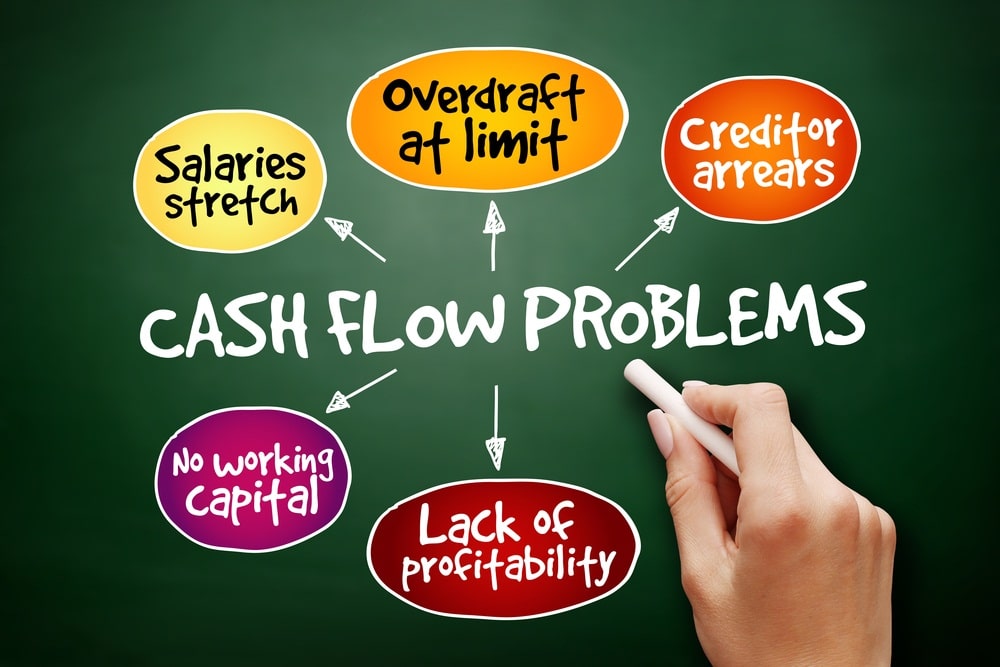

Startups face unique challenges, often operating in uncharted territories with innovative, untested products or services. Amidst this uncertainty, maintaining a positive cash flow can often seem like a herculean task. Cash flow mistakes are unfortunately common, and can be lethal to the sustainability of a business venture. From poor planning and unrealistic financial projections to inefficient processes and unplanned emergencies, these cash flow mistakes can strangle a startup’s liquidity, impede its operational capabilities, and limit its growth potential.

The good news, however, is that most of these cash flow mistakes can be anticipated and avoided with careful planning, disciplined execution, and continuous monitoring. This guide serves to shine a light on some of the biggest cash flow mistakes your startup is probably making, providing you with actionable solutions to navigate around them and ensure the financial health of your business.

1. Not Having a Cash Flow Forecast

Startups often operate under a lot of uncertainties, which can make financial planning challenging. However, operating without a cash flow forecast is like navigating through uncharted waters without a map. It can lead to impulsive financial decisions, overspending, or underestimating the cash needed for important business operations.

Resolution: A cash flow forecast can help you predict peaks and troughs in your cash balance, enabling you to make informed financial decisions. It helps you to anticipate periods of cash shortage and take appropriate actions such as cutting costs or arranging for a credit line in advance. Keep updating your cash flow forecast on a regular basis to keep it aligned with your business’s actual performance and the evolving market conditions.

2. Overestimating Revenue

Many startups are optimistic about their products or services and tend to overestimate the revenue they’ll generate. While optimism is essential in business, overconfidence in sales projections can lead to spending more than what actually comes in, thereby straining your cash flow.

Resolution: Adopt a conservative approach while estimating your revenues. Consider factors such as market size, competition, pricing, sales cycle length, and customer acquisition cost in your revenue projections. Regularly review and update your revenue estimates based on actual sales data and market trends.

3. Underestimating Costs

Startups are often focused on growth and may underestimate or overlook certain costs in the process. These could be regular operating expenses like rent and utilities, variable costs like production materials, or unexpected costs like equipment repairs.

Resolution: Keep a close track of all your expenses, both fixed and variable. Plan for unexpected costs by setting aside a portion of your budget for emergencies. Regularly review your costs to identify any areas where you could cut back without impacting your business operations or growth.

4. Not Having a Cash Buffer

Many startups operate with just enough cash to cover their immediate expenses, leaving them vulnerable to unforeseen events such as a sudden drop in sales, loss of a major client, or a global crisis like a pandemic.

Resolution: Experts typically recommend having enough cash reserves to cover at least three to six months of operating expenses. This provides a safety net to keep your business afloat during tough times. Consider building your cash reserves through methods such as reinvesting profits, securing lines of credit, or raising additional investment.

5. Late Invoicing

Invoicing promptly and regularly is critical to maintaining a healthy cash flow. However, in the hustle and bustle of managing a startup, invoicing often gets pushed to the back burner. This can delay the cash inflows and disrupt your cash cycle.

Resolution: Establish a systematic invoicing process. Set aside dedicated time for invoicing or consider using automated invoicing software. Make your payment terms clear and follow up politely but firmly on overdue payments.

6. Not Managing Inventory Efficiently

Poor inventory management can result in too much capital tied up in unsold goods, or worse, loss of sales due to stock-outs. This is especially crucial for product-based startups where inventory costs typically represent a significant portion of the total expenses.

Resolution: Implementing an effective inventory management system can help optimize stock levels based on sales trends and lead times. Adopt inventory management techniques such as Just-In-Time (JIT) or Economic Order Quantity (EOQ) to minimize stock holding costs without compromising on sales.

7. Not Negotiating Payment Terms with Suppliers

By accepting the default payment terms offered by suppliers, startups might find themselves paying for inventory long before they convert it into sales, which can create a cash crunch.

Resolution: Try to negotiate favorable payment terms with suppliers such as extended payment periods, partial payments, or payment upon selling. This can help improve your cash cycle and maintain a healthy cash flow. Remember, everything is negotiable in business.

Conclusion

A startup’s journey is invariably marked by a high degree of uncertainty and risk. However, when it comes to cash flow management, leaving things to chance can be a perilous gamble. Recognizing the common cash flow mistakes is the first step towards setting your startup on the path to financial stability and success.

Each of the cash flow mistakes outlined in this guide provides an opportunity for learning and growth. By proactively addressing these issues, startups can not only avert potential cash flow crises but also unlock new opportunities for efficiency and growth.

From maintaining meticulous cash flow forecasts and setting realistic financial expectations to optimizing operational processes and negotiating favorable terms, every strategy you employ can significantly contribute to sustaining your cash flow. In the volatile and competitive world of startups, cash flow management might just be the difference between the startups that merely survive and those that truly thrive.

Remember, it’s not always about how much money your startup makes; it’s about managing when and how it flows. As a startup founder or financial manager, adopting effective cash flow management practices is not just an integral part of your role, but also a crucial investment in your startup’s future.