In 1971 fresh-faced Yale graduate Fred Smith founded a company called Federal Express with $95 million. (That’s roughly the equivalent of $578 million in 2017.) Just three years later, Federal Express was on the rocks.

Smith had burned through his $95 million and had just $5,000 in the bank. Facing a fleet fuel bill of $24,000, the future looked bleak. In a moment of madness, Smith bought a plane ticket to Las Vegas and went straight to the nearest roulette table he could find.

By the end of the night, Smith had quintupled his money and won enough cash to keep his fledgeling startup running for another month.

Fast forward four decades. Federal Express (now FedEx) is a global success story, having reinvented the way we send packages. At the time of writing, FedEx employs over four hundred people and processes 13 million shipments every single day. See the graph below to see just how fast FedEx grew after its initial blip.

Okay, you might be wondering what the point of this story is. The point I’m trying to make is that even huge multinational conglomerates like FedEx hit rough patches and have challenges.

If you tackle challenges the correct way with the correct attitude, you can ride out the worst upsets. However, if you bury your head in the sand, you might as well close your doors now.

In this article, I’ll share some advice from my role as a business rescue specialist. I’ll highlight four areas that are incredibly important for startups and small businesses. If you watch out for these issues, it’ll be easier to keep your business on the right track and follow FedEx all the way to global success.

Build in wiggle room

Things rarely go as smoothly in the real world as they do in your business plan. Big contracts never land, old clients decide to leave, and key staff members retire. Unexpected hurdles are just par for the course. Just think about Fred Smith from before. Do you really think he planned to burn through $95 million dollars and rely on blackjack winnings? Of course not!

Unfortunately, new business owners tend to write a business plan, budget the bare minimum and assume that everything will go exactly to plan. When something does go wrong — and something always goes wrong — those idealistic new directors suddenly find themselves hurtling towards disaster without the resources to divert their course.

The solution for this is simple. Don’t assume that everything will go to plan.

Instead, assess risks and build in wiggle room wherever you can afford it. If things do start going wrong, you’ll be thankful that you have the resources to give yourself some breathing room.

Remember credit control

Startups and small business really struggle with credit control. If you’re anything like me, this might strike you as odd. Small, cash-strapped businesses should be chasing up payments wherever they can. But they’re not.

In a lot of cases, they’re ignoring credit control and passively collecting payments whenever their clients and customers feel like paying. This is mind boggling but I think I know why it happens.

Small businesses, by their very definition, have small workforces and because they have small workforces staff members often have to take on multiple roles. After working with SMEs for several years, the two roles I see merged most often are sales and credit control.

Now, I understand why the roles get merged together as one is the natural continuation of the other. You sell something then collect the payment. It’s basically two halves of the same thing, right? Well, kind of. Although the two jobs are very closely linked, the professional relationships are very different.

Your sales staff need to be close to your customers. They need an intimate understanding of their problems and the ability to suggest solutions. If they’ve built up that relationship over months or years, it’s going to be fairly awkward to suddenly start asking why they haven’t paid their latest invoice. Often, sales staff will ignore credit, feeling that their job is already done.

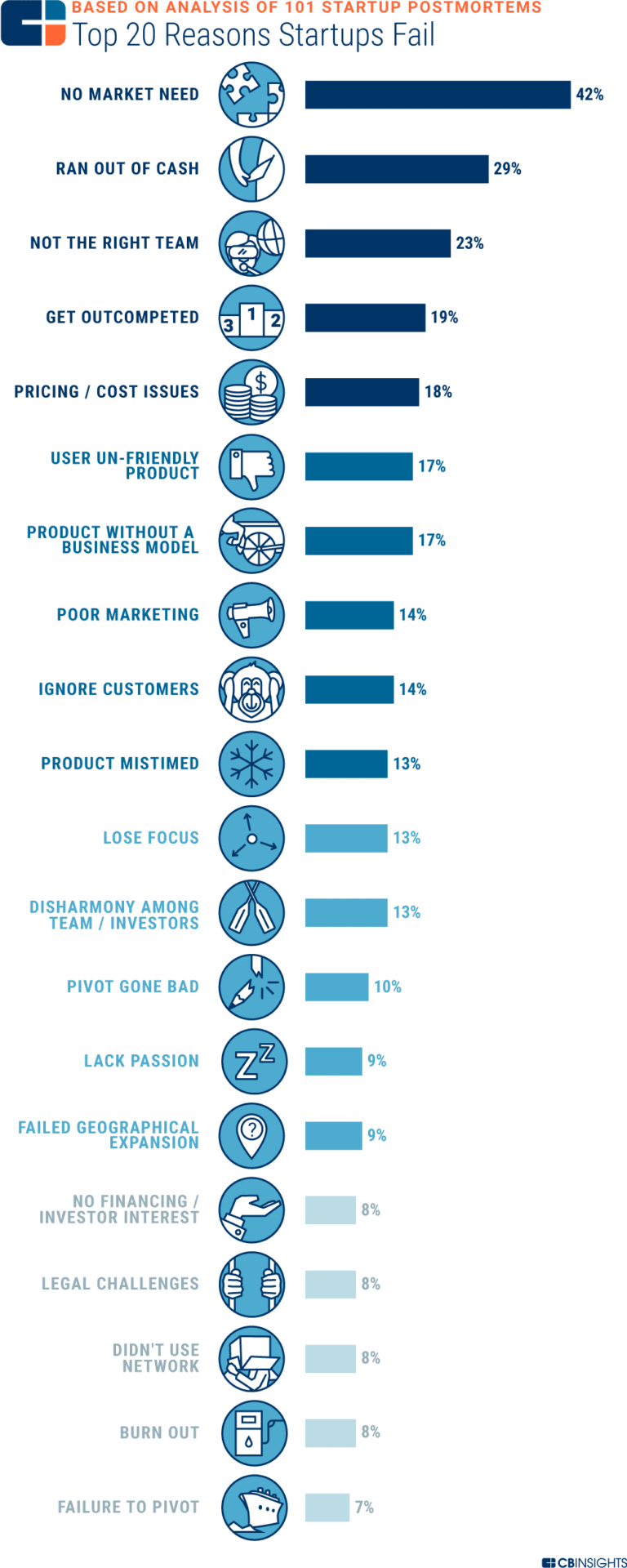

This is clearly not ideal and if it’s left unchecked, poor credit control can wreck your cash flow. Just look at CB Insights latest analysis of startup failures.

The second most common cause of startup failure is running out of cash, which is directly linked to not keeping control of your credit control.

So, how do you fix it? The simplest solution is to separate the two roles. Have sales staff who sell and bookkeepers who chase up payments.

However, many small businesses don’t have enough in their budget to create a dedicated credit control role. For these businesses (actually for all businesses) here is some general credit control advice to keep your cash flow healthy.

First, write clear, consistent and strong credit terms. When a customer agrees to your terms, they should know exactly what is required of them and how the agreement is enforceable.

Second, keep in contact to keep your business at the head of the queue. The reality of life is the creditors who shout loudest tend to get paid first. So, if you want to be paid first, it’s important to keep calling and emailing reminders.

Third, if an invoice due date comes and goes without your customer paying, it’s important to not let it slide. Now, automated emails and letters are good but I’ll let you in on a secret. The most effective credit control tool you have is the phone. It’s very easy to mark an email as unread and forget about it for a few weeks.

Phone calls, however, are much more difficult to ignore. Plus, if you call and get someone on the phone, it’s a personal conversation, which is — again — very difficult to ignore.

Understand where you’re heading

Okay, after a nice easy introduction, let’s jump into a more technical area: forecasts. A lot of founders will shy away from forecasts, thinking they are an overly formal business tool. That, I think, is ridiculous. Forecasts are an excellent tool for all sizes of business and should play a central part in your business planning.

First things first, what is a forecast. A forecast is simply a prediction of how your business will perform in the future. And why is that helpful? Well, if you know how your business will perform in the next six months, you can estimate your finances, growth and resource needs.

Here is a quick example. If your forecasts show that you’ll need to hire in a couple of months, you can start the recruitment process now so you’re ready when you actually need to bring someone on. If you didn’t have forecasts, you might hit your breaking point before you realise that you have to hire someone.

Unfortunately, even when business owners do create forecasts, I often see them incorrectly. Many will treat these forecasts as a one-off task that they tick off when they’re writing their business plan and then never revisit again.

This is a huge mistake. Forecasts are living documents and, like all living things, need love, care and attention. As your business grows and develops, you must revisit your forecasts and update them based on what you’ve learned.

Know your limits

Startup founders and small business directors rarely just run the business. With small teams and smaller budgets, founders can often find themselves handling customer service complaints, helping with production, chasing up late payments and, in short, doing just about everything that needs doing.

That breeds this mindset that they can do almost anything they set their mind to. While that mindset is great for getting a cash-strapped business off the ground, it isn’t always a good thing.

With a lot of roles early on, you have time and space to learn. If you design a bad logo, it isn’t necessarily the end of the world. If you fluff a big pitch, it’ll hurt but your business can survive. However, if your business starts to struggle, business recovery is not one of those things. If you mess up your recovery, it can mean the end of your business. It’s that simple.

My advice is simple: if you believe your business is starting to struggle, seek help now. The more time you give a business rescue professional, the higher the chances of a successful rescue. Don’t bury your head in the sand, don’t double down on risky gambles and don’t flail about when you don’t know what to do. Find a local business rescue specialist and ask their advice.

About the author: Barry Stewart is a chartered accountant and has specialised in corporate recovery, restructuring and personal insolvency since 1999. Barry recently co-founded financial advice firm 180 Advisory Solutions.