Financial metrics are a collection of assessments used in accounting to appraise the performance, profitability, and liquidity of a business. They are statistical measures collected by businesses to assess their financial performance over a period, generally expressed in percentage or dollar terms. The utilization of financial metrics not only helps in understanding a company’s past performance but also aids in predicting future health of the business.

Tracking financial metrics is essential for the survival and success of small businesses. These metrics provide a snapshot of the business’ financial condition, allowing owners and managers to make informed decisions and devise strategies for growth. Moreover, regular monitoring of these metrics can help detect potential issues early, providing the chance for early intervention before they escalate into significant problems.

Top 10 Key Financial Metrics for Small Business Success:

Revenue Growth

Revenue growth refers to the percentage increase in sales of the business over a specific period. It serves as an indicator of the effectiveness of sales and marketing strategies and the perceived value of services or products offered by the business.

Revenue growth can be calculated by subtracting the revenue of the previous period from the revenue for the current period, then dividing the result by revenue from the previous period and multiplying by 100 to obtain a percentage.

For small businesses, revenue growth is a critical indicator of sustainability and viability. High revenue growth signifies increased customer base or improved sales, suggesting that the business is performing well and attracting more customers. Additionally, prospective investors or lenders often look at a company’s revenue growth before deciding on investment or lending.

Profit Margin

Profit margin is another important financial metric that illustrates the profitability of a company. It is the proportion of revenue that a business gets to keep as profit after accounting for all its costs.

Profit margin is calculated by dividing net profit by total revenue and then multiplying the result by 100 to get a percentage. The higher the profit margin, the more profitable the company.

A healthy profit margin is vital for the growth and success of small businesses. It indicates the efficiency of a business in controlling its costs and provides insight into its pricing strategy. Understanding the profit margin allows small businesses to identify areas where they can reduce expenses and increase profits.

Gross Profit Margin

Gross profit margin is a financial metric that measures a company’s efficiency at using labor and supplies in the production process. It is a key indicator of a company’s financial health and business model.

Gross profit margin is calculated by subtracting the cost of goods sold from total sales revenue, and then dividing the result by total sales revenue, the result is multiplied by 100 to get the percentage.

A healthy gross profit margin indicates that a business is effectively managing its resources and production processes. It is a valuable tool for comparing a company’s business model and operational efficiency with other companies in the same industry. If the gross profit margin is declining, it could signify a problem that needs to be addressed.

Operating Profit Margin

Operating profit margin is a key profitability ratio that measures how much profit a company makes on a dollar of sales, after subtracting the cost of goods sold and operating expenses, but before paying interest or taxes.

Operating profit margin is determined by subtracting operating expenses from gross profit, dividing this result by revenue, and multiplying by 100 to get a percentage. Higher margins mean the company is more efficient at converting sales into actual profit.

Operating profit margin provides insight into how well a company manages its operating costs. Small businesses need to closely monitor this metric because it directly impacts their profitability and has a significant effect on their growth strategy.

Return on Investment (ROI)

Return on investment (ROI), is a popular profitability metric that is used to measure the likelihood of gaining a return from an investment. It shows the efficiency of an investment in generating profit, comparing the profit from an investment to the cost of the investment.

Return on investment is calculated by subtracting the cost of the investment from the gain from the investment, dividing the result by the cost of the investment, and then multiplying the result by 100 to get a percentage.

ROI provides small businesses with a means to measure the return on different investments, such as marketing campaigns, equipment purchases, and more. It allows businesses to compare the effectiveness of various investments and determine which investment offers the best return.

Current Ratio

The current ratio, also known as the working capital ratio, is a liquidity ratio that measures a company’s ability to cover its short-term liabilities with its short-term assets.

The current ratio is calculated by dividing a company’s current assets by its current liabilities. A higher current ratio indicates a more promising default risk.

A solid current ratio is vital for small businesses. It shows the company’s ability to pay back its debts and run day-to-day operations. An inadequate current ratio could suggest financial problems in the future, making it a critical indicator to monitor regularly for any small business.

Quick Ratio

The quick ratio, also known as the acid-test ratio, is a financial metric that measures a company’s short-term liquidity position. This ratio is more stringent than the current ratio as it excludes inventories from current assets.

The quick ratio is computed by subtracting inventories from current assets and then dividing by current liabilities. A quick ratio greater than 1 means a company’s most liquid assets are adequate to cover its short-term liabilities.

The quick ratio is crucial for small businesses as it indicates how well they can meet their short-term financial liabilities with quick assets. It’s a good indicator of a company’s financial strength and short-term liquidity, especially in crisis situations.

Debt to Equity Ratio

Debt to equity ratio is a financial metric that indicates the proportion of a company’s financing obtained through debt compared to shareholder equity. It provides an indication of a company’s risk level to investors and lenders.

Debt to equity ratio is calculated by dividing a company’s total liabilities by its shareholder equity.

Understanding the debt to equity ratio is important in small business financial planning as it reflects a company’s financial leverage. A lower debt to equity ratio is generally more preferable, indicating less risk to investors and creditors.

Cash Conversion Cycle

The cash conversion cycle (CCC) is a metric that expresses the time it takes for a company to convert its investments in inventory and other resources into cash flows from sales.

CCC is calculated by adding the days inventory outstanding (DIO) and the days sales outstanding (DSO) then subtracting the days payable outstanding (DPO). The shorter the cycle, the more efficient the company’s working capital management.

The cash conversion cycle is crucial for small businesses as it provides insight into their liquidity, efficiency, and overall financial health. A shorter CCC means that a company can quickly turn its inventory into cash, providing better cash flow.

Inventory Turnover

The inventory turnover ratio is a measure of the number of times inventory is sold or used in a time period such as a year. It’s used to analyze the efficiency of inventory management within a business.

Inventory turnover ratio is calculated by dividing cost of goods sold by average inventory for the period.

Monitoring the inventory turnover can help small businesses make better decisions about pricing, manufacturing, marketing, and purchasing new inventory. Higher turnover rates suggest that the company is selling its products quickly and efficiently, resulting in increased profitability.

Implementing these Financial Metrics

Implementing these financial metrics in your small business requires an organized and systematic approach. Begin by determining which metrics align with your business goals. Use automated bookkeeping software to easily track these metrics and regularly review and analyze the results. Make adjustments to business strategies based on the insights gained from these metrics.

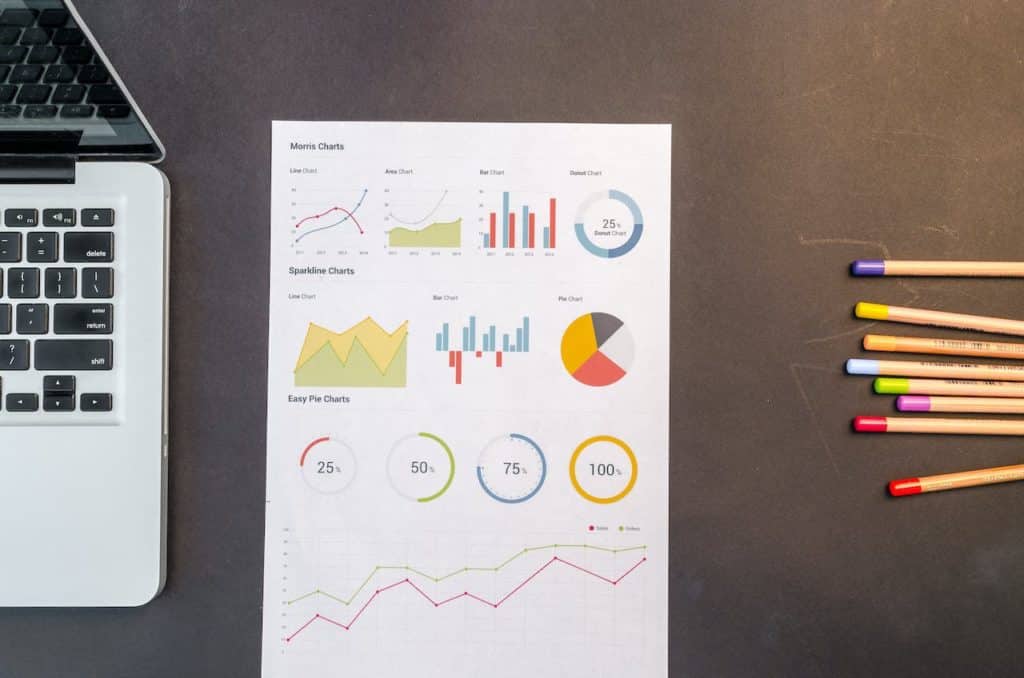

There are several tools and software available that can assist in tracking and analyzing these financial performance metrics. Accounting software like QuickBooks, FreshBooks, and Xero can automatically track some of these metrics and provide easy-to-understand reports. Dashboards like Tableau can visualize these metrics, making them easier to understand at a glance.

There are numerous examples of small businesses successfully implementing these financial metrics. For instance, a small retail business could improve its cash flow by monitoring its inventory turnover ratio and reducing unnecessary inventory. On the other hand, a start-up tech company could attract investors by showing strong revenue growth and a high ROI. By tracking and optimizing these financial metrics, small businesses of all types can achieve sustained growth and success.