Launching a startup with limited resources? Don’t despair. Various funding options await, each with unique advantages and challenges.

From bootstrapping to seeking angel investors, your choice could significantly impact your company’s future.

Carefully consider the pros and cons of each path to determine the best way to fuel your entrepreneurial dreams and set your startup on the road to success.

Bootstrapping

Bootstrapping empowers entrepreneurs to launch their startups using personal savings and revenue, maintaining full control without relying on external investors. This approach allows you to focus on building your business without the pressure of meeting investor expectations or giving up equity.

You’ll need to be resourceful, carefully managing your finances and prioritizing essential expenses. To bootstrap effectively, start by minimizing costs. Consider working from home or a shared workspace instead of renting an office. Utilize free or low-cost tools and services for tasks like accounting, marketing, and project management.

You can also investigate bartering or partnering with other businesses to exchange services. As your business grows, reinvest profits to fuel further expansion. This method requires patience and discipline, but it can lead to a more sustainable and self-reliant company in the long term.

Family and Friends

Turning to family and friends for startup funding can be a viable option when you’re seeking initial capital without the formalities of traditional financing. This approach allows you to tap into your personal network for support, often with more flexible terms than conventional loans.

Nonetheless, it’s vital to treat these investments professionally to avoid potential conflicts. When considering this route, you should clearly communicate your business plan and the risks involved. Set clear expectations about repayment terms or equity stakes. It’s wise to document all agreements in writing to prevent misunderstandings.

Be prepared for the possibility that mixing business with personal relationships can lead to strain if the venture doesn’t succeed as planned. Furthermore, consider the impact on family dynamics and friendships if financial issues arise. While this funding method can provide quick access to capital, it’s imperative to weigh the potential personal consequences carefully.

Angel Investors

For entrepreneurs seeking more substantial funding without tapping personal connections, angel investors offer a promising alternative. These high-net-worth individuals provide capital in exchange for equity or convertible debt.

Angel investors typically invest in early-stage startups, offering not just money but also valuable expertise and industry connections.

When considering angel investors, keep in mind:

- They often invest between $25,000 and $100,000

- Many prefer to invest in industries they’re familiar with

- They may require a seat on your company’s board

- You’ll need a solid business plan and pitch to attract them

Angel investors can be found through networking events, online platforms, or angel investor groups. They’ll conduct due diligence on your startup before investing, so be prepared to share detailed financial projections and growth strategies.

While they expect high returns, angel investors are often more patient than venture capitalists, making them ideal for startups not yet ready for VC funding.

Venture Capital

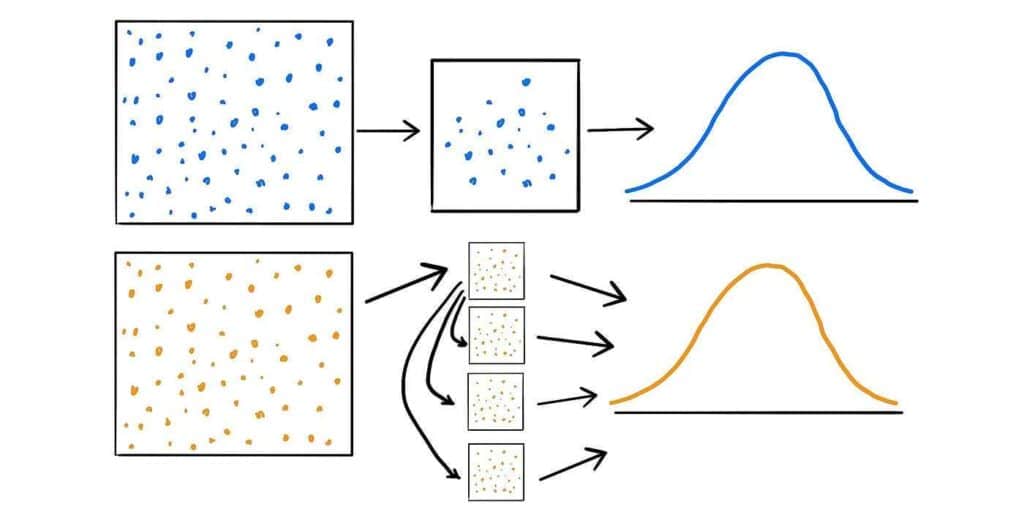

Venture capital ramps up the funding game for startups seeking substantial investment and rapid growth. These firms invest large sums of money in exchange for equity, typically targeting companies with high growth potential.

You’ll find that venture capitalists often provide more than just capital; they offer strategic guidance, industry connections, and operational support.

When you’re considering venture capital, you’ll need to prepare a solid business plan and pitch deck. VC firms usually focus on specific industries or stages of company development, so research potential investors carefully.

You’ll likely go through multiple rounds of funding, starting with seed capital and progressing to Series A, B, and beyond. Each round typically involves larger investments and higher company valuations.

Keep in mind that venture capital comes with expectations of significant returns, so you’ll need to demonstrate a clear path to profitability and scalability.

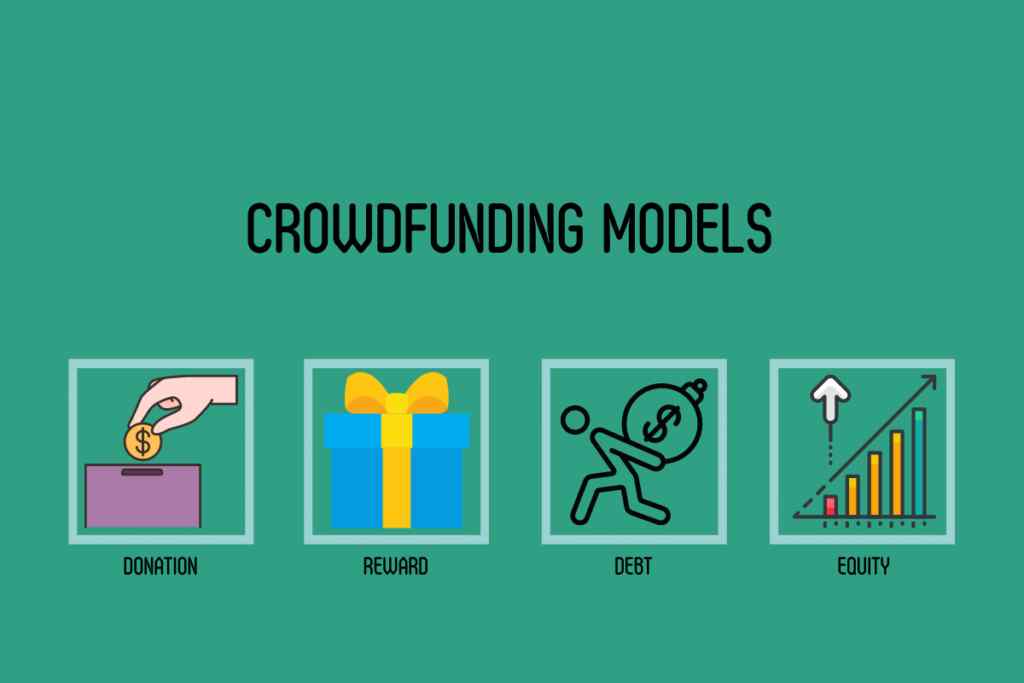

Crowdfunding

Crowdfunding harnesses the power of the masses, allowing startups to raise capital through small contributions from a large number of people. You’ll find various crowdfunding platforms online, each with its own focus and audience.

When you launch a campaign, you’ll need to create a compelling pitch that outlines your business idea, goals, and how you’ll use the funds.

Some key benefits of crowdfunding include:

- Validates your product or service idea

- Builds a community of supporters and potential customers

- Provides marketing exposure for your startup

- Offers a low-risk way to test market interest

You’ll need to set a funding goal and often provide rewards or perks to backers based on their contribution level. It’s important to plan your campaign carefully, considering factors like marketing strategy, campaign duration, and fulfillment of rewards.

Crowdfunding can be an effective way to jumpstart your startup’s growth.

Conclusion

You’ve now investigated the top five funding options for startups, each with its own advantages and challenges.

While some may argue that seeking external funding dilutes control, it’s important to acknowledge that the right funding strategy can provide vital resources and expertise to accelerate your startup’s growth.

Carefully consider your business needs, growth plans, and risk tolerance when choosing a funding option.

With the right approach, you’ll be well-positioned to turn your startup vision into a thriving reality.